irs child tax credit 2022

It is possible that. Last year the tax credit was also fully refundable meaning that if the credit amount a.

Net Of Tax Irs Fresh Start Initiative In 2022 Tax Capital Gain Irs

The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

. If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit. BestPlaces data for child care expenses is the annual cost of child care for both home-based care and at larger child care centers. That is the first phaseout step can reduce only the 1600 increase for qualifying children age 5 and under and the 1000 increase for qualifying children age 6 through 17 at the end of 2021.

Depending on your income you must have earned income of. 2022 Child Tax Credit. You may be eligible for a child tax rebate of up to a.

02242022 Publ 972 SP Child Tax Credit Spanish Version 2022 02252022 Form 1040-SS. For the 2022 tax year the credit goes back to 2000 per eligible child. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17.

For children under 6 the amount jumped to 3600. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. Businesses and Self Employed.

This year the credit was expanded in an effort to help alleviate the financial difficulties caused by the pandemic. Wait 5 working days from the payment date to contact us. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

Businesses and Self Employed. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. The most recent version of the Build Back Better plan would extend the expanded child tax credits 3000 and 3600 for the 2022 tax year.

These FAQs were released to the public in Fact Sheet 2022-28 PDF April 27 2022. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments only going to families that earned enough income to owe taxes.

File a federal return to claim your child tax credit. Earned Income Tax Credit. Prior to 2021 the Child Tax Credit maxed out at 2000 per eligible dependent.

Samantha Parish June 21 2022 600 AM Updated. Self-Employment Tax Return Including the Additional Child Tax Credit for. If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per child under 6 and 3000 per child ages 6 to 17.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less generous. Child Tax Credit.

June 20 2022 1232 PM While many states are creating their own child tax credit 2022 will look different than 2021 when it comes to the IRS. Advance Child Tax Credit. In urban areas the cost is for care at a child care center and for home care in rural areas.

If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. For the year 2021 the child tax credit saw a temporary increase to as much as 3600 per child thanks to the American Rescue Act. Not only that it would have modified it to include the following.

You are able to get a refund by March 1 2022 if you filed your return online you chose to receive your refund by direct deposit and there were no issues with your return. Instructions for Form 1040-SS US. These Child Tax Credit frequently asked questions focus on information needed for the tax year 2021.

Parents and children participate in a demonstration organized by the ParentsTogether Foundation in support of the child tax credit portion of the Build Back Better bill. The IRS recently revised the 2021 Child Tax Credit and Advance Child Tax Credit Payments Frequently Asked. In the meantime the expanded child tax credit and advance monthly payments system have expired.

The American Rescue Plan Act ARPA of 2021 expanded the Child Tax Credit CTC for tax year 2021 only. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. Tax Year 2021Filing Season 2022 Child Tax Credit Questions and Answers Topics.

Rather its maximum value will simply return to 2000. This provision allows you to deduct a certain amount of money from your taxable income if you have a qualifying child. Figure represents the average of costs for annual care of an infant and a 4-year-old.

This post explains those rules as well as what you should do if you never got the advanced child tax credit for 2021. 2021 Child Tax Credit Basics. Simple or complex always free.

2022 Child Tax Rebate. Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico 2021 01212022 Inst 1040-SS. In 2022 the tax credit could be refundable up to 1500 a rise from 1400 in 2020 due to inflation.

The notice is informing you the IRS already adjusted the Child Tax Credit claimed on your return. 455 Hoes Lane Piscataway NJ 08854 Phone. The child tax credit will go back to normal in 2022.

The child tax credit isnt going away. The first phaseout can reduce the Child Tax Credit down to 2000 per child. Find Us On Google Maps.

These payments were part. If you disagree with the changes we made you can call us at the toll-free number listed on the top right corner of your notice. The IRS child tax credit has been a part of the tax code since 1997.

This year the credit isnt gone. Earned Income Tax Credit. The good news is.

The payments are part of the 19 trillion. March 11 2022 516 AM 2 min read. Contact Us By Phone Text or Fax.

Posted on April 4 2022 by Chris Dios Posted in Tax Tips. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Eitc 2022 What If Two People Claim The Same Dependent Marca

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

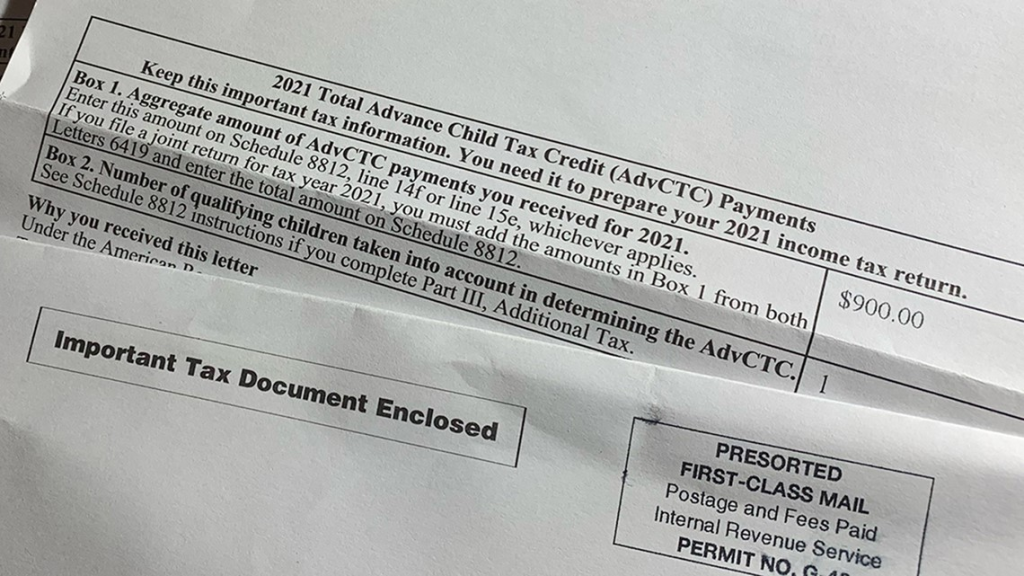

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Credit Card Visa Hack Pdf Personal Identification Number Automated Teller Machine In 2022 Digital Transformation Executive Leadership Hvac Business

Irs Fresh Start Is Here To Help You In 2022 Fresh Start Irs Lost Hope

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance Irs Taxes Tax Table Tax Brackets

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Usa Finance And Payments News Summary 19 April As Usa

Expansion Of Child Tax Credit Helped Feed Children In W Va Wvpb

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca