broward county business tax receipt form

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax. Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954-831-4000 FAX 954-357-5479.

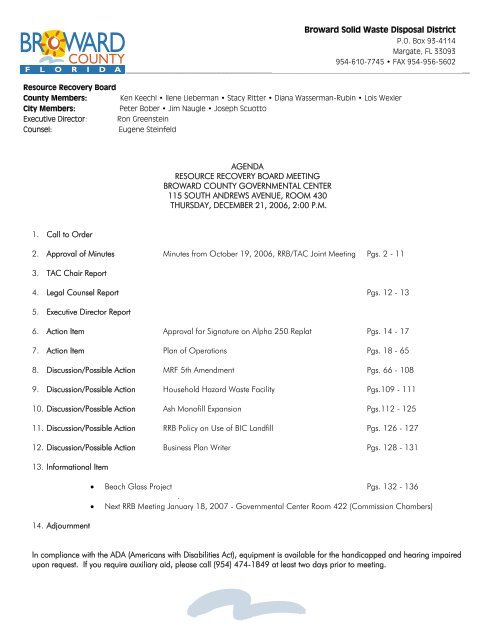

Broward Solid Waste Disposal District Agen Broward County

Records Taxes and Treasury.

. Broward County Tax Collector. Taxpayers registering for Tourist Development Tax may be required to obtain a Broward County Local Business Tax Receipt. You can also mail your documents with the service fee to.

We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with. Broward Florida Receipt Template for Small Business. CBE PROGRAM Project Value 250000 Project Value 250000 100 of the project is reserved for SBEs.

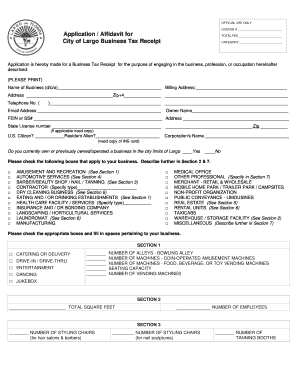

APPLICATION FOR BUSINESS TAX. Lauderdale FL 33301-1895 954-831-4000 VALID OCTOBER 1 THROUGH SEPTEMBER 30. Use the buttons below to apply for a new Business Tax account and obtain your Broward County Business Tax receipt or request a change to your.

Is this profession or the type of business being conducted regulated by the Florida Department of Financial Services this includes but is not limited to. Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954-357-8077 FAX 395-468-3476 APPLICATION FOR BUSINESS. PROGRAM ELIGIBILITY Personal net worth per owner 132 million Firm Business.

Local Business Tax Receipt Application Form PDF 135 KB Broward County - Fictitious Name Form PDF 223 KB List of Local Business Tax Receipt Categories PDF 342 KB Local. PROGRAM ELIGIBILITY Personal net worth per owner 132 million Firm Business. How To Pay Tourist Development.

When you pay a Local Business Tax you receive a Local Business Tax Receipt which is valid for one year from October 1 through September 30. Tax License Section. Welcome to Broward County BTExpress.

Board of County Commissioners Broward County Florida Finance and Administrative Services Department REVENUE. New businesses may also present applications for a Broward County Local Business Tax Receipt in person at Broward County Records Taxes and Treasury Division Governmental Center. REVENUE COLLECTION DIVISION - Tax License Section 115 S.

If you do not renew your Countys Business Tax Receipt by September 30 it becomes delinquent October 1 and you will be assessed a penalty if you attempt to renew for the following year. Click here for more information. BROWARD COUNTY LOCAL BUSINESS TAX RECEIPT 115 S.

State of Florida Administrative Code 68A-6002 State of Florida Fish Wildlife Commission - Permits and License Applications Local Business Taxes Affidavit for Transfer of Local. Or Call 954831-4000 Fax 954357-5479. Check Our Frequently Asked Questions.

CBE PROGRAM Project Value 250000 Project Value 250000 100 of the project is reserved for SBEs. Any person who was not liable for a business tax during the first half of the business. The term of business tax receipts and transfer fees shall be as provided in Chapter 205 Florida Statutes.

Summons Notice To Appear For Pretrial Conference Remote Appearance Pdf Fpdf Docx Florida

Motion For Default And Default 608 Pdf Fpdf Doc Docx Florida

City Of Largo Business Tax Receipt Form Fill Out And Sign Printable Pdf Template Signnow

Fill Free Fillable Broward County Florida Pdf Forms

Statement Of Claim 633 Pdf Fpdf Doc Docx Florida

Free 5 Sample Business Tax Receipts In Ms Word Pdf

Fill Free Fillable Broward County Florida Pdf Forms

Affidavit To Transfer Broward County Local Business Tax Receipt

Marriage License Broward County Fill Online Printable Fillable Blank Pdffiller

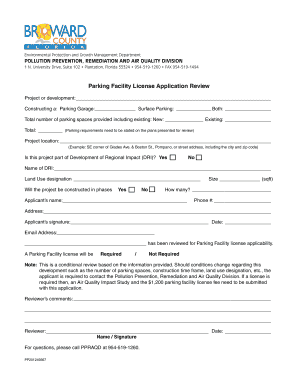

Broward County Review Certificates 305 300 0364

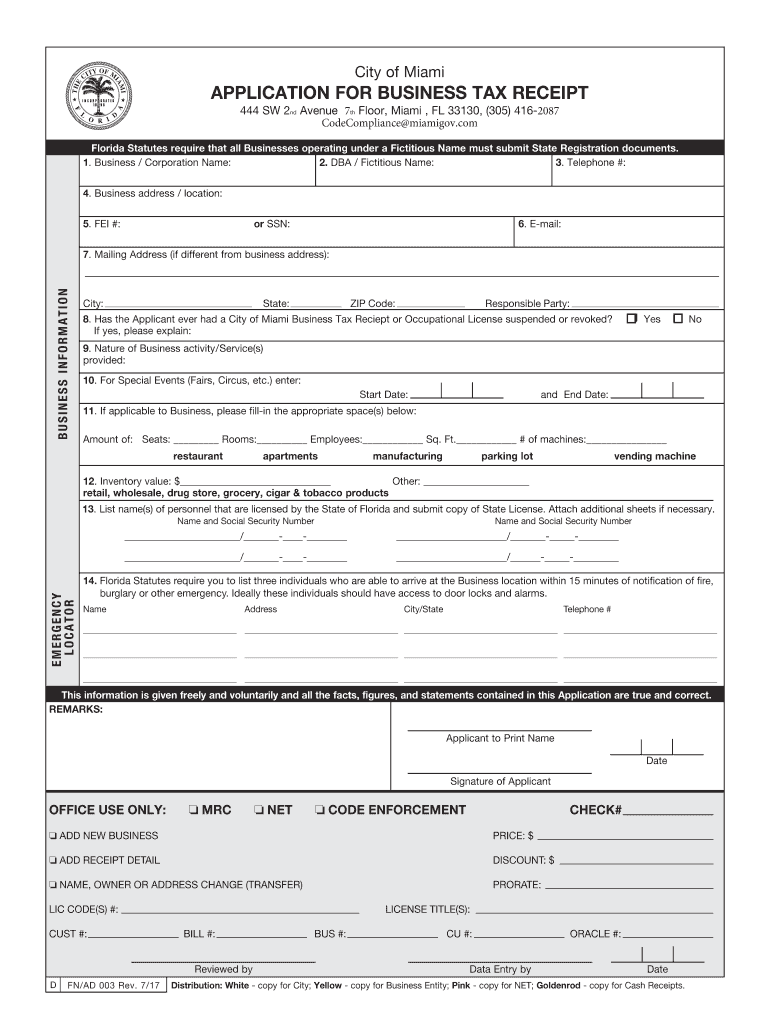

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Business Tax Receipts Davie Fl

Broward County Property Appraiser

Coronavirus Oakland Park Fl Official Website

Permit Source Information Blog